HERE’S WHY YOU NEED LONG-TERM DISABILITY INSURANCE

The no-brainer benefit for business owners

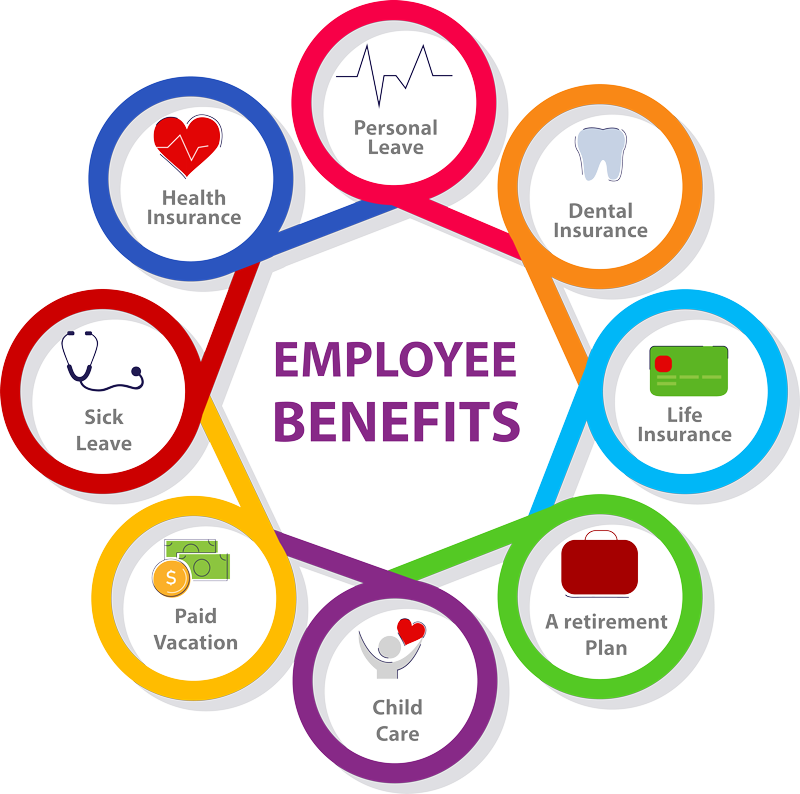

Business owners of all sizes are saddled with the big responsibility of building an employee benefits package that is both incentivizing and cost-effective.

It’s an endless game of “Pros  vs. Cons” that can feel impossible to win. However, there’s one underrated benefit that checks all the boxes: Long-Term Disability Insurance.

vs. Cons” that can feel impossible to win. However, there’s one underrated benefit that checks all the boxes: Long-Term Disability Insurance.

What is Long-Term Disability Insurance?

Also referred to as “Paycheck Insurance,” Long-Term Disability Insurance (LTD) provides partial income support for individuals with an illness or injury that prevents them from working. In contrast to Short-Term Disability coverage, LTD payouts can be drawn upon as needed for an extended period—be it three months or up until the age of retirement. Coverage ranges from 40-70% of total income, which provides a financial cushion when unexpected circumstances render an employee physically or mentally unable to do their job.

Trust the Professional Opinion

New Jersey-based insurance and benefit expert, Susan Payne, is one of the industry’s most passionate advocates for Long-Term Disability coverage.

It’s such an effective yet underrated benefit,” Payne says. “It’s a simple way for companies to offer their employees financial peace of mind.”

As President and Founder of Susan Payne & Associates Inc., Payne has helped write group health insurance policies for businesses, individuals, and families for 20+ years.

3 Reasons to Consider Long-Term Disability

It’s a much-needed financial safety net

1 in 5 adults live with a disability while 1 in 4 of today’s 20-year-olds will become disabled before reaching retirement age. Additionally, surveys show that most employees are concerned about income should they be forced to stop working. Factoring in out-of-pocket medical bills only emphasizes this anxiety.

Policies are affordable and easy to implement

Long-Term Disability coverage is one of the most cost-effective benefits on the market, plus onboarding LTD benefits for your employees is seamless—especially when you’re working with a compassionate and knowledgeable team like Susan Payne’s.

You’ll attract and retain great talent

Benefits are a critical incentive in a competitive job marketplace. When it comes to disability coverage, offering financial assistance that’s untethered to employment status is a perk that can’t be underplayed.

Get Started With Long-Term Disability Insurance

If you’re interested in implementing a Long-Term Disability policy (or have questions about additional employee benefits), don’t hesitate to contact Susan Payne & Associates for a free consultation today!